iedge s reit

On the flip side of chasing yield via mortgage REITs the nearly 1 billion REZ fund offers a play on real estate that is limited only to US. REITs provide an investment opportunity like a mutual fund that makes it possible for everyday Americansnot just Wall Street banks and hedge fundsto benefit from valuable real estate present the opportunity to access dividend-based.

Any Opinion Whether It S Worth Investing The New Ipo Csop Iedge S Reit Leaders Index Etf Seedly

The investment objective of CSOP iEdge S-REIT Leaders Index ETF the Sub-Fund is to replicate as closely as possible before fees and expenses the performance of the iEdge S-REIT Leaders Index the Index First Trust Advisors LP.

. The units of the Sub-Fund the Units are traded on. The ETF has several unique characteristics which stand out in particular. According to present data Csop Iedge S-reit Leaders Indexs Csop Iedge S-reit Leaders Index shares and potentially its market environment have been in bearish cycle last 12 months if exists.

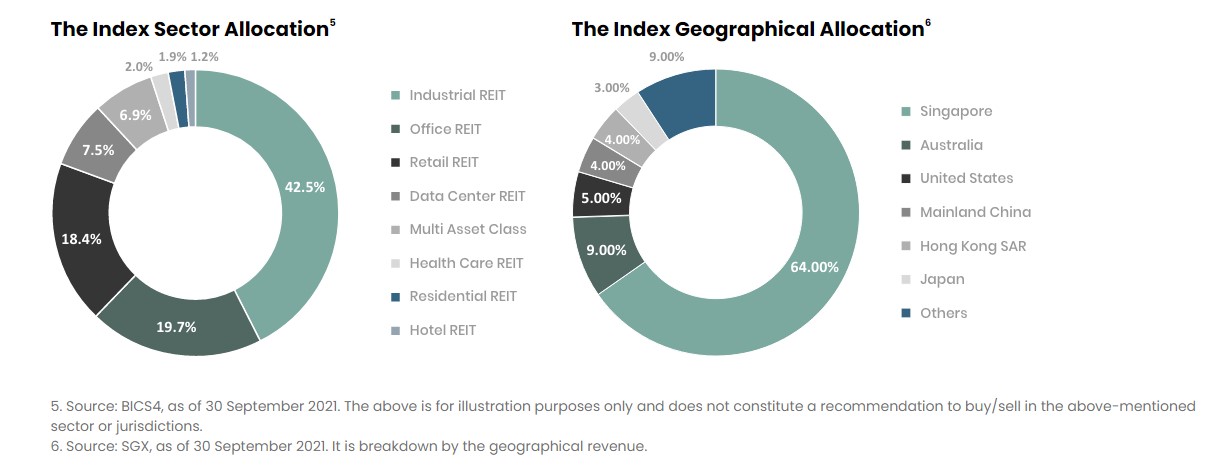

If we assume dividends are not reinvested the returns would have been 431. SGX as of 30 June 2021 6 Source. Proxied by iEdge S-REIT Leaders SGD Index Total Return 4 Source.

Annaly Capital invests in real estate and related assets including agency mortgage-backed securities MBS residential and commercial real. IEDGE S-REIT INDEX REIT. The iEdge S-REIT Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid real estate investment trusts in Singapore in SGD.

Bloomberg 14 October 2011 15 October 2021. Download the Complete REIT Excel Spreadsheet List at the link above. The CSOP iEdge S-REIT Leaders Index ETF is a Sub-Fund of the CSOP SG ETF Series I Unit Trust.

The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014. A real estate investment trust REIT is a company that owns operates or finances income-producing real estate. If youre looking to build a diversified REIT portfolio the iEdge S-REIT Leaders Index is one option to consider.

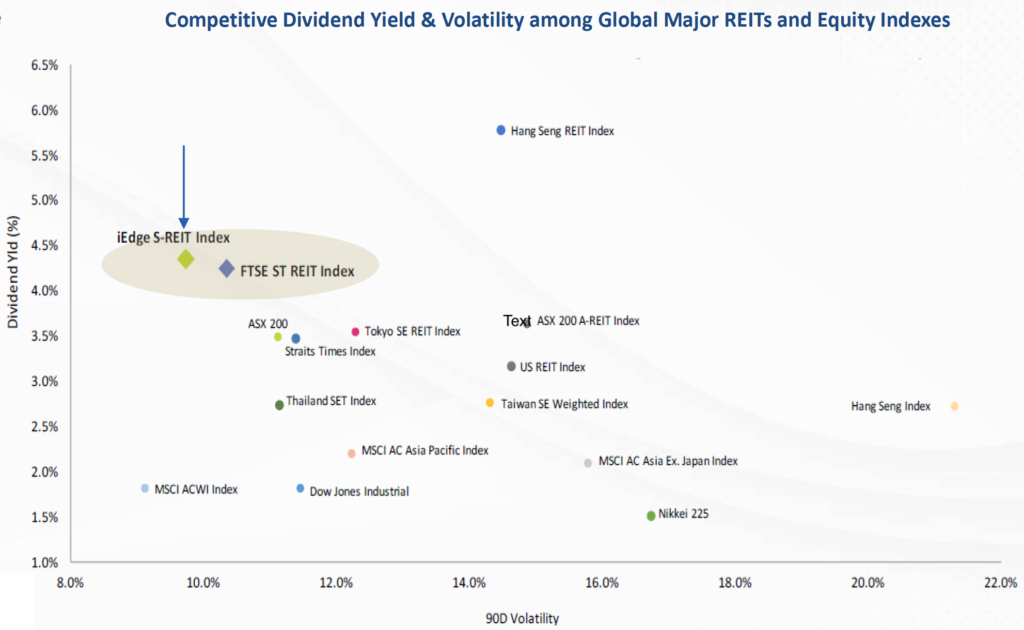

The latest 12-month dividend yield is at 408 as of 31 October 2021. Bloomberg SGX as end of 2020 2 Source. The CSOP iEdge S-REIT Leaders Index ETF the Sub-Fund is a sub-fund of the CSOP SG ETF Series I Unit Trust which is a Singapore unit trust.

It tracks the largest and most liquid REITs in Singapore including household names like Ascendas REIT Mapletree Commercial Trust and CapitaLand Integrated Commercial Trust. Best Value REITs. See more on advanced chart Markets Indices.

Annaly Capital Management Inc. It has delivered an annualised return of 992 in the past 5 years and a dividend yield last 12 months of 396. SGX as of 30 September 2021 5 Source.

Click on the filter icon at the top of the Dividend Yield column in the Complete REIT Excel Spreadsheet List. SGX as of 30 September 2021. Before you think about investing in the CSOP iEdge S-REIT Leaders Index ETF here are 4 things about the ETF that you should first know.

The Sub-Fund is a passively managed index tracking ETF authorised under Section 286 of the Securities and Futures Act Chapter 289 of Singapore. The Sub-Fund is a passively managed index-tracking ETF with an investment objective of replicating closely the performance of the iEdge S-REIT Leaders Index the Index. View live IEDGE S-REIT INDEX chart to track latest price changes.

Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet. Declares Monthly Distribution for First Trust Enhanced Short. Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange SGX.

SGXREIT trade ideas forecasts and market news are at your disposal as well. Our Ai fund analyst implies that there will be a positive trend in the future and the Csop Iedge S-reit Leaders Index shares might be good for investing. It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore.

2 months 3 months 6 months 9 months 1. Refers to dividend yield of iEdge S-REIT Leaders Index. Use the filter functions Greater Than or Equal To and Less Than or Equal To along with the numbers 005 ad 007 to display.

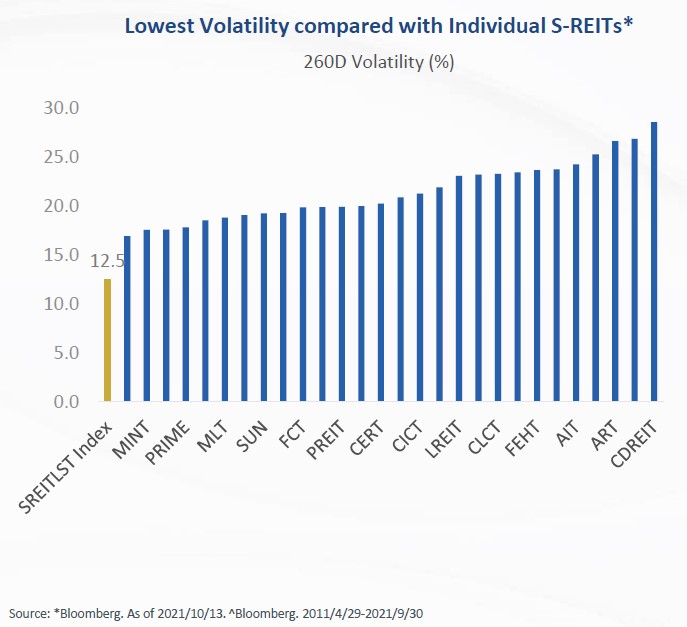

For the case of CSOP iEdge S-REIT Leaders Index ETF it comprises a total of 28 of the most liquid REITs with a total net asset value of S1169m As the top 10 constituents comprise a huge weightage towards the entire ETF at 7729 and they are as follows with its weightage at the time of writing this post in brackets along with a brief. Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested. A real estate investment trust in Singapore S-REIT is a fund on SGX that invests in a portfolio of income generating real estate assets such as shopping malls offices or hotels usually with a.

The index is one of Singapores most popular REIT indices. Search Ctrl K. To ensure that the REITs tracked by the index are the most liquid REITs the iEdge S-REIT Leaders Index employs a liquidity-adjustment strategy.

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

南方东英iedge新加坡房地产投资信托领先指数etf将在新交所上市 Business Wire

Why Singapore Reit Investors Should Consider Investing Via The Iedge S Reit Leaders Index

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Reits Report Card 2021 How Singapore Reits Performed In 2nd Quarter 2021

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

What You Need To Know About Csop Iedge S Reit Leaders Index Etf The Singaporean Investor

Csop Iedge S Reit Leaders Index Etf Poems

S Reit Report Card Here S How Singapore Reits Performed In Fourth Quarter 2019

Constituents Of The Iedge S Reit Index Companies Markets The Business Times

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Comments

Post a Comment